S&P 500 wouldn’t have performed nearly as well as it did in Q1-2023 if it wasn’t for the AI boom.

The S&P 500 index has seen tremendous growth this year. This was primarily driven by 5 companies: Apple, Microsoft, Alphabet (Google’s parent), Amazon, and Nvidia. Though the first 4 are the usual suspects of the $1 trillion market cap club, Nvidia is a new name in this club. Nvidia temporarily became a $1 trillion company as well thanks to AI. But out of the $2.9 trillion increase in market cap of all 5, a significant portion is thanks to heavy R&D into artificial intelligence and machine learning.

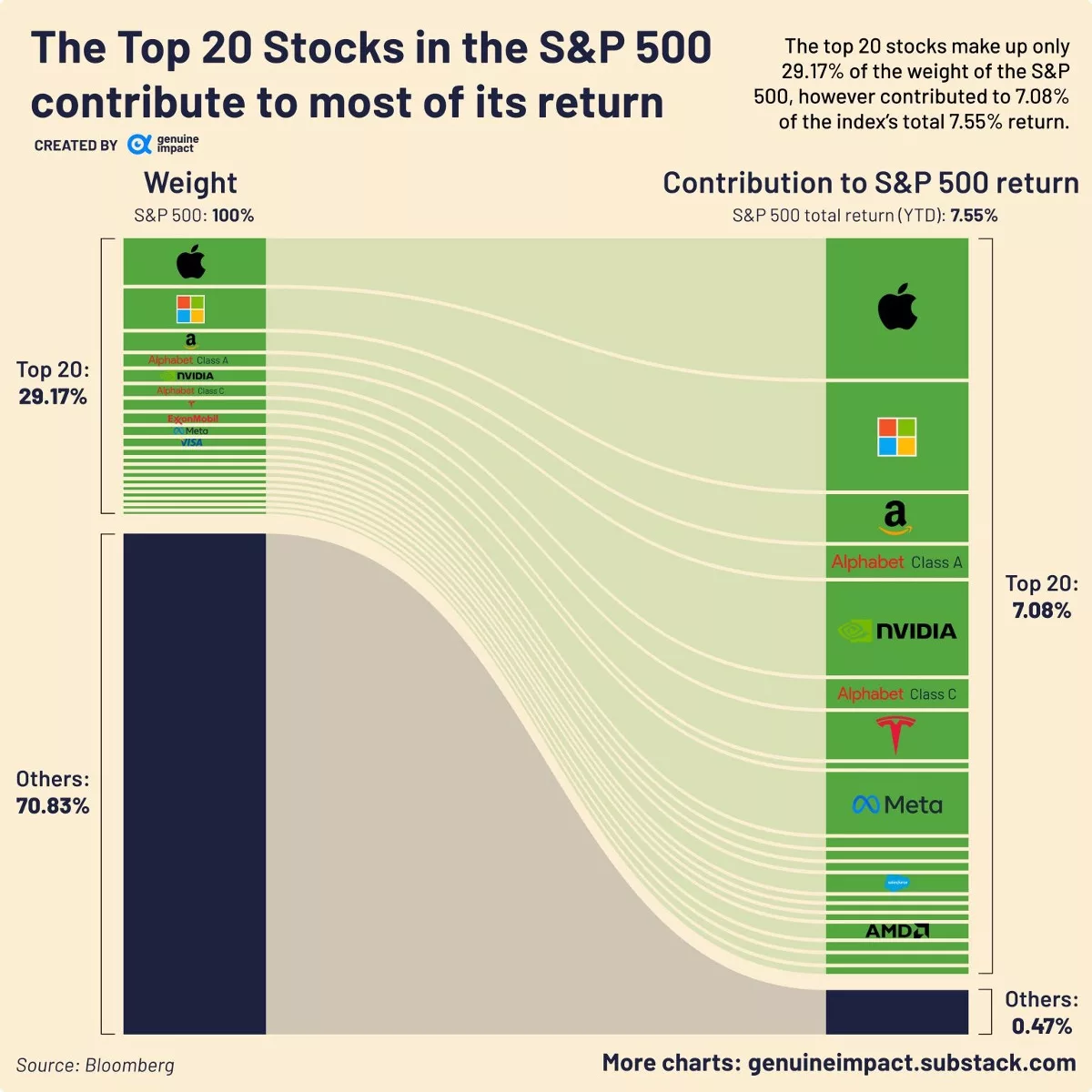

The rest of the 495 companies in the index contributed a meager 4% of the total gains, and the bottom ~71% of the 500 companies contrubuted less than 0.5% of all returns.

Apple is the only company in the bunch not dabbling with well-funded AI projects. In fact, the majority of its $718 billion increase this year was due to strong iPhone sales, as expected.

- Microsoft has a strong cloud computing business that’s been boosted by AI and its investment into OpenAI is paying off with products such as Office 365 and Bing incorporating GPT-4.

- Nvidia is a company that makes GPUs that handle AI-related workloads. Relying on these hardware accelerators through data centers is pretty much a prerequisite for any company that wishes to train its own AI language models. In fact, Nvidia’s growth can be seen as a significant correlation to the growth of new AI models itself. The company soared 110% this year, carried mainly by the AI boom.

- Alphabet’s Google has also rolled out its own plethora of AI tools apart from Bard—The ChatGPT competitor. Much like Microsoft, Google is also integrating its own LLM called the PaLM (version 2 now) into its products such as Docs and Gmail. Notably, Google’s cloud unit has turned a profit for the first time.

- Amazon exceeded its Wall Street estimates driven mainly by strong operating income and layoffs. The company is also working on AI projects. Amazon’s secret AI project called Burnham was leaked just last month.

A majority of the S&P 500 gainers include AI companies. If you take these companies out, S&P 500 would’ve been at a loss of 1%. Even Goldman Sachs pundits are estimating that generative AI could boost S&P 500 profit margins by ~4% over the next 10 years once we hit widespread adoption.

It’s no coincidence that the number of S&P 500 companies citing “AI” on their earnings calls has skyrocketed in the last quarter. A total of 110 companies did so in Jan-Mar 2023 as per a FactSet study.